Thruster Finance: Navigating Market Volatility

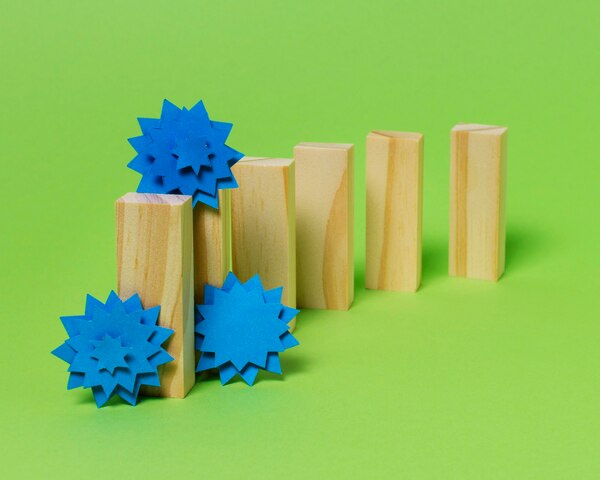

Market volatility is an inherent aspect of the financial world, presenting both risks and opportunities for investors. In such turbulent times, it is pertinent to adopt a structured approach to safeguard investments and maximize returns. Thruster Finance, a reputed financial advisory firm, has spearheaded initiatives to help investors navigate through these choppy waters effectively.

Understanding Market Volatility

Market volatility refers to the rate at which the price of securities increases or decreases for a given set of returns. It is often driven by economic factors, geopolitical events, changes in market sentiment, or unexpected news. Volatility can create uncertainty and anxiety among investors, leading to irrational investment decisions. However, for the astute investor, these periods of uncertainty can also present unique opportunities to si4dh on mispriced assets.

Thruster Finance's Approach

Thruster Finance employs a multi-faceted approach to help its clients successfully navigate market volatility. This strategy revolves around three core principles: diversification, risk management, and informed decision-making.

- Diversification

One of the cardinal rules of investing during volatile times is diversification. By spreading investments across a variety of asset classes, sectors, and geographies, investors can mitigate the risk associated with any single investment. Thruster Finance advocates for a balanced portfolio that includes equities, fixed-income securities, commodities, and real estate. The firm’s financial advisors work closely with clients to construct portfolios that align with their risk tolerance, investment horizon, and financial goals.

- Risk Management

In periods of market turbulence, risk management becomes paramount. Thruster Finance emphasizes the importance of a proactive risk management strategy. This includes setting stop-loss orders, regularly reviewing asset allocations, and rebalancing portfolios as necessary. Additionally, the firm provides tools for scenario analysis and stress testing, enabling investors to evaluate how their portfolios would perform under different market conditions. These measures help cushion the impact of market downturns and provide a disciplined framework for making investment decisions.

- Informed Decision-Making

Knowledge is power, particularly in volatile markets. Thruster Finance equips its clients with comprehensive market research, real-time data, and expert analysis to make informed decisions. The firm’s dedicated team of analysts monitor market trends, economic indicators, and corporate earnings to provide timely insights. Regular updates and personalized advisory sessions ensure that clients are well-informed and can adapt their investment strategies as needed.

Leveraging Opportunities

While volatility can induce apprehension, it also creates opportunities for investors willing to take calculated risks. For instance, market corrections can offer entry points into fundamentally strong stocks at attractive valuations. Thruster Finance encourages its clients to adopt a long-term perspective, focusing on the intrinsic value of investments rather than short-term market fluctuations. For seasoned investors, the firm provides access to advanced trading strategies, such as options and futures, to si4dh on market movements.

Emotional Discipline

A significant aspect of navigating market volatility is maintaining emotional discipline. The market’s ups and downs can provoke emotional reactions that lead to impulsive decisions. Thruster Finance emphasizes the importance of keeping emotions in check and adhering to a well-defined investment plan. Regular consultations with financial advisors can provide reassurance and help investors stay committed to their long-term objectives.

Conclusion

Navigating market volatility requires a combination of strategic planning, risk management, and informed decision-making. Thruster Finance stands as a trusted partner for investors, offering the expertise and resources needed to weather market storms and seize opportunities. By embracing diversification, implementing robust risk management practices, and making informed decisions, investors can navigate market volatility with confidence and resilience. Thruster Finance’s commitment to client success ensures that investors are well-equipped to achieve their financial goals, regardless of market conditions.